How Sst Works In Malaysia

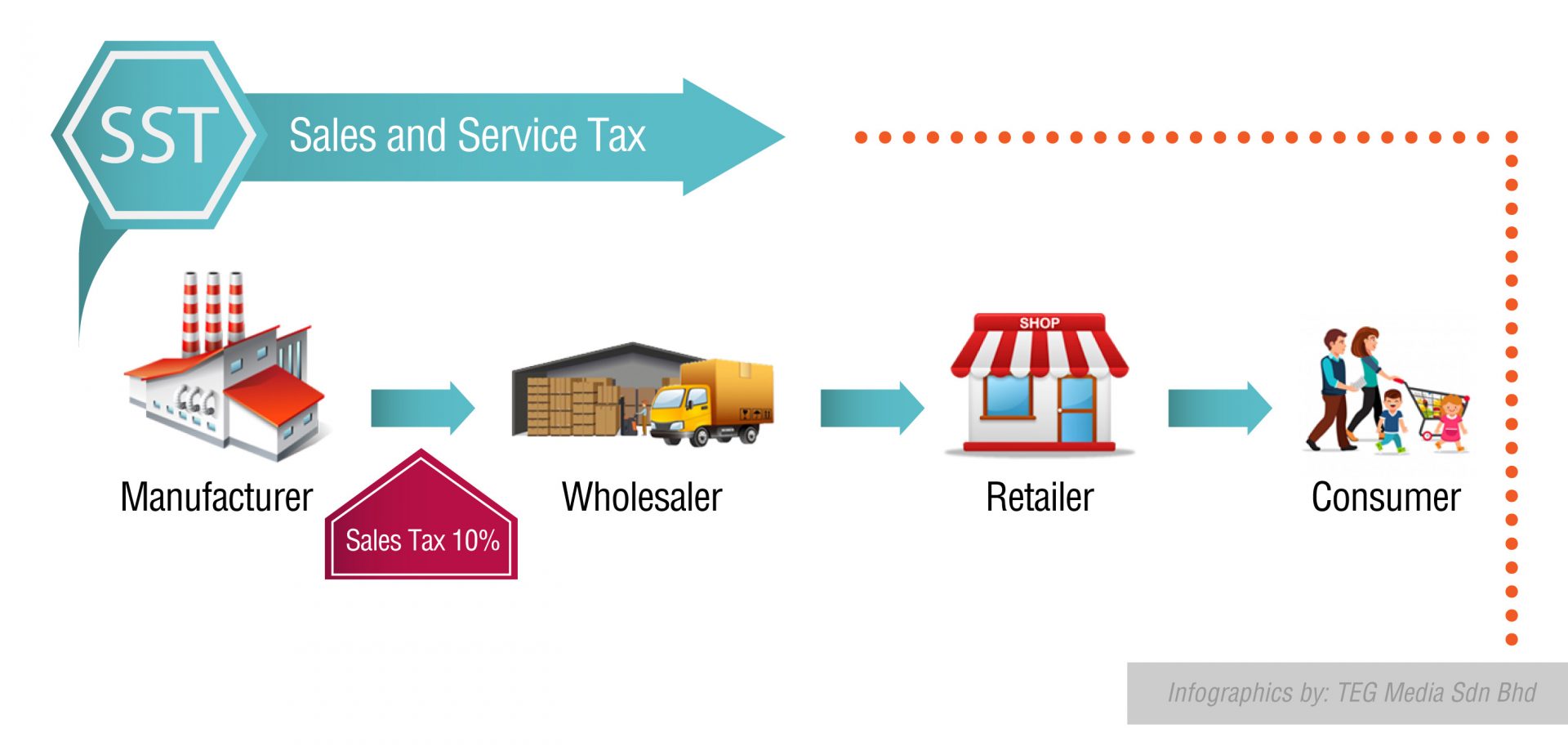

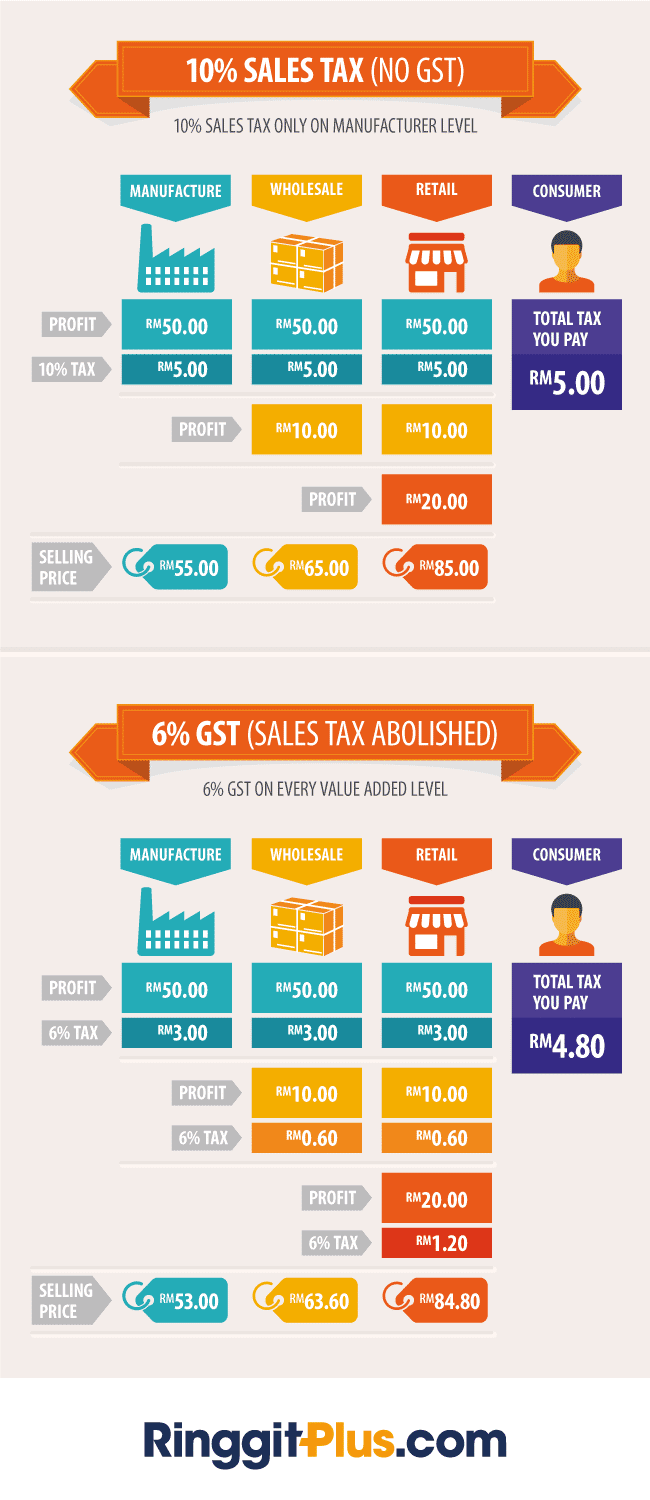

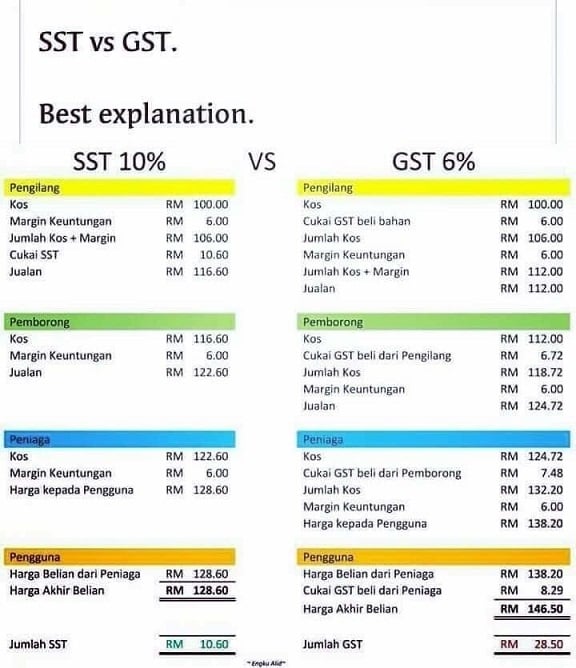

Actually the tax system is going to replace the existing good and service tax gst method.

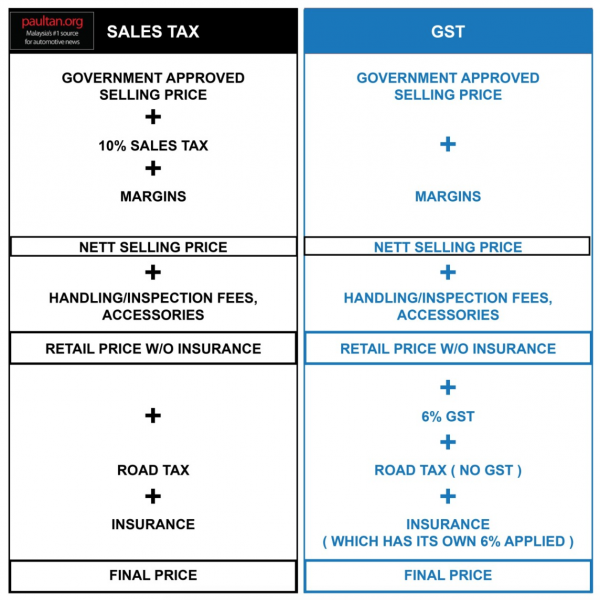

How sst works in malaysia. Follow malaysia s budget 2020 live updates here. The new sales tax will be imposed at a rate of either 5 10 or a specific amount will be for petroleum products. There has been plenty of talk recently in relation to the goods and services tax gst and the sales and service tax sst and what the impact of each is to the consumers. I the sst will be a single stage tax where the sales ad valorem tax is charged upon taxable goods manufactured and sold by a taxable person in malaysia and taxable goods.

Sales and service tax sst in malaysia. The general consensus is that with sst back in the system some prices have seen a decrease but it remains to be seen whether prices will stay that way as there is still room for price adjustments. There is also plenty of information that has been made available to the public through various sources including the social media in some instances adding to the confusion on how these taxes operate. The reintroduction of the sales and services tax sst will see its rate set at 10 for sales and 6 for services.

It s been a week since the ge14 elections and what a time it is indeed to be alive. Most commonly known as value added tax. Malaysia s new sales and service tax or sst officially came into effect on 1 september replacing the former goods and services tax gst system and requiring malaysian businesses to adjust to a new regime. Our new article breaks down the facts and figures behind the switch from gst to sst.

One of the things that have been widely discussed is the return of the sst after a 3 year implementation of. The new sst was implemented in the country in the 1970s but was abolished. The government has confirmed that the sst tax rate will be set at 10 for sales and 6 for services. The single stage taxation also means that businesses incur lower costs and that fewer businesses are impacted.

The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018. Sst in malaysia and how it works. The service tax rate will be 6. This was announced by finance minister lim guan eng on 16 july 2018 who informed that the bill on sst will be passed in parliament sometime in august.

The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018. This is imposed on services as well as goods meant for domestic consumption.