How To Avoid Custom Tax In Malaysia

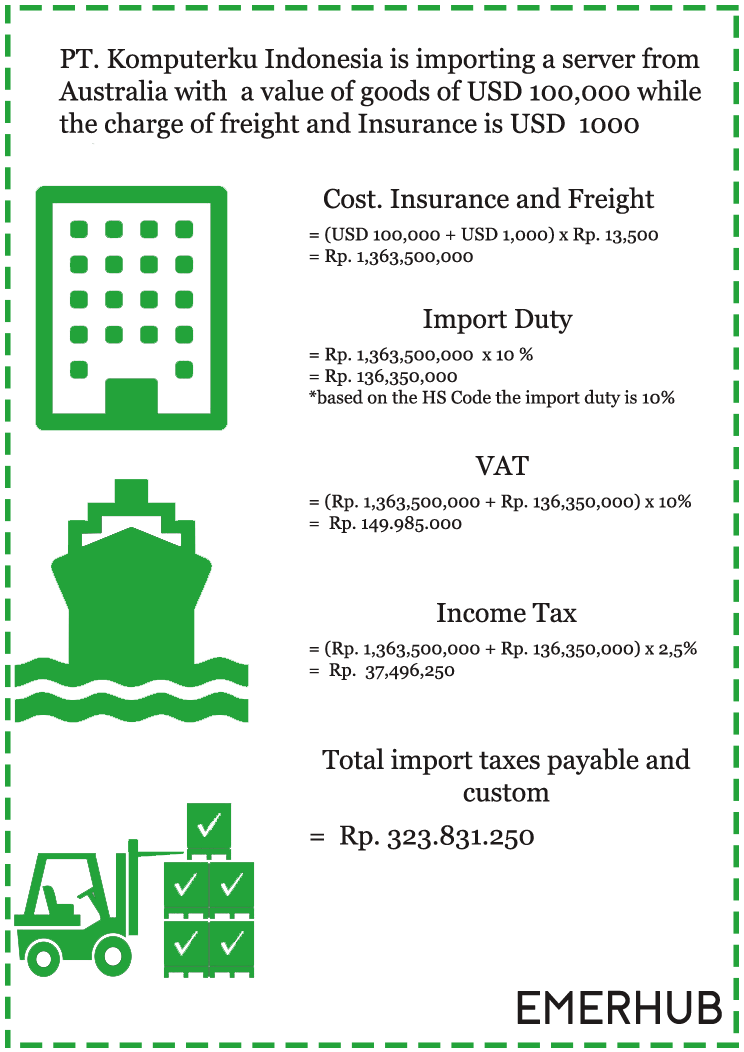

And taxes payable are calculated on the complete.

How to avoid custom tax in malaysia. Customs duties or import duty a tax charged on certain goods which are brought into a coun. Goods purchased online for personal use you may be charged customs duties and taxes for something purchased online because. And taxes will be pending and need to be cleared while importing goods into malaysia either by a private individual or a commercial entity. But otherwise if i just buy 1 2 items even if it s just 52 pounds i don t get taxed.

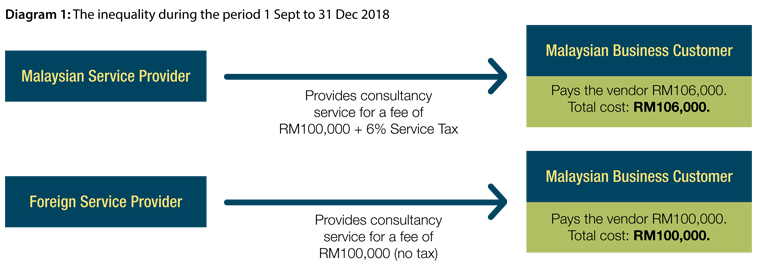

Shipper s guide to duties and taxes. The valuation method is cif. Malaysian customs imposes a standard goods and service tax gst on imported goods at 6 percent. The import duty a tax charged on certain goods which are brought into a coun.

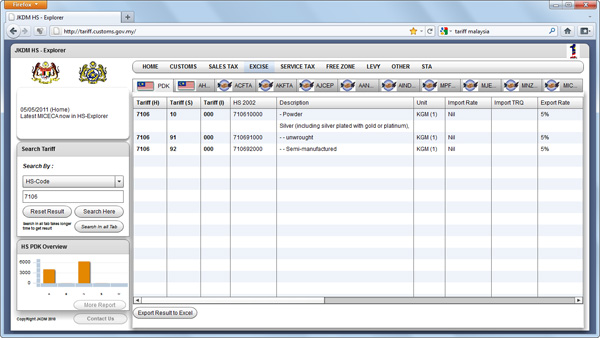

For example leather may be taxed more than vinyl and new goods may be taxed more than used or repaired goods. Be sure to include all necessary information on your commercial invoice since this is how customs authorities will classify and process your shipment. Income tax 10 if you have an indonesian tax id 20 if you don t have an indonesian tax id if your shipment is worth more than usd 1 500 regular import taxes based on the product s hs code apply. Rattan from peninsula of malaysia.

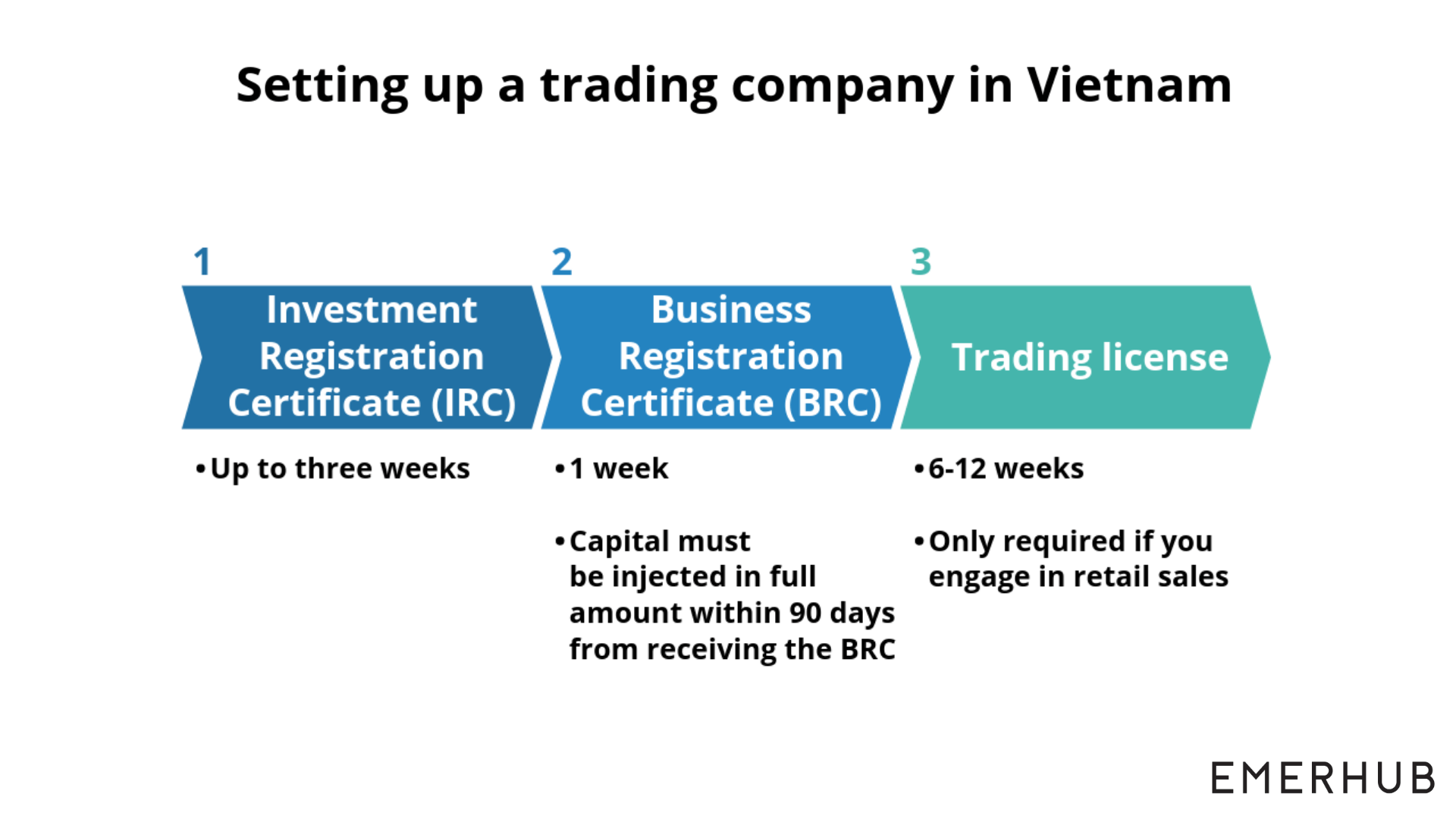

Your items may be assessed differently by your country s customs authority depending on how they were made. Make sure to describe your item as accurately as possible on your shipping request form in order to avoid unnecessary taxes. Any animal or bird other than a domestic animal or domestic fowl whether alive or dead or any part thereof. Getting the required documents in advance is vital if you want to avoid hold ups at the border.

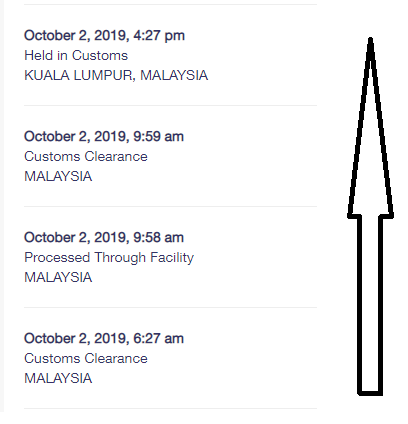

If your package is subject to customs taxes you will receive a notice from customs via pos malaysia informing you that your package is subject to taxes. I ve bought items from asos and once i got taxed as there were about 5 6 items in the package. When shipping internationally it s important to understand duties and taxes. Knowing all costs upfront and clearly communicating with your customer how it will be paid will result in a smoother shipping experience.

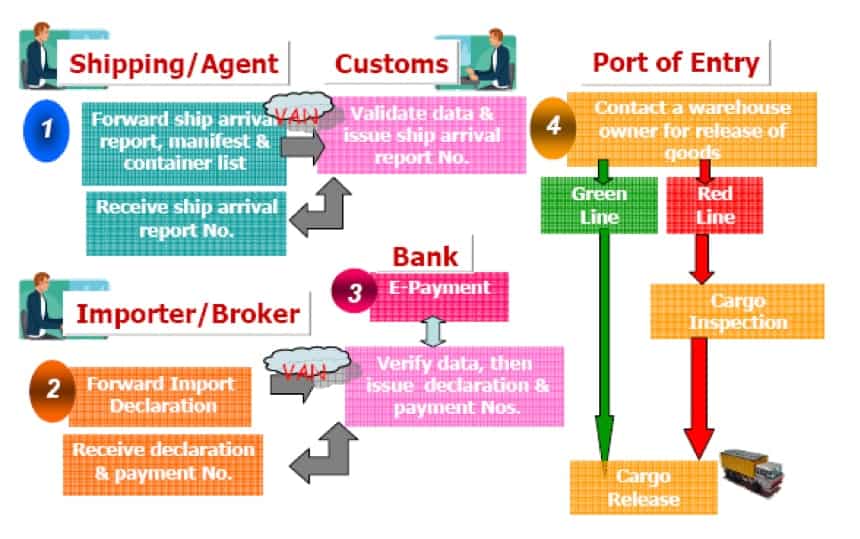

When transporting goods across international borders shipments are subject to duties and taxes as determined by customs in the destination country. The following are some of the goods which require an export licence permit from relevant authorities. Calculate duties taxes to malaysia estimate your tax and duties when shipping to malaysia calculate. Under malaysia s customs act 1976 tariffs paid on exported goods which were originally sourced from imports are.

Malaysia customs apply a tariff on exported goods between 0 to 10 percent following ad valorem rates.