How To Buy Bonds In Malaysia

Bank negara malaysia bnm also issues rulings for approvals for certain types of bonds including non tradable and non transferable bonds issued to non residents.

How to buy bonds in malaysia. Thus most investors buy municipal bonds through brokerage accounts. The malaysia 10y government bond has a 2 670 yield. In 2019 ifast becomes malaysia s first retail bond eligible distributor in transacting bond and sukuk with retail investors. The securities commission sc regulates the issue and offer of corporate bonds and sukuk in malaysia.

Select the transaction type either purchase or sale. The bond market guide 2016 for malaysia is an outcome of the strong support and kind contributions of asean 3 bond market forum members and experts particularly from malaysia. The report should be recognized as a collective good to support bond market development among asean 3 members. Fundsupermart is established in singapore hong kong malaysia and india.

Central bank rate is 1 75 last modification in july 2020. And fund analysis tools on the website and mobile applications. Please note that trading on bursa malaysia is on dirty price. Key in the dirty price.

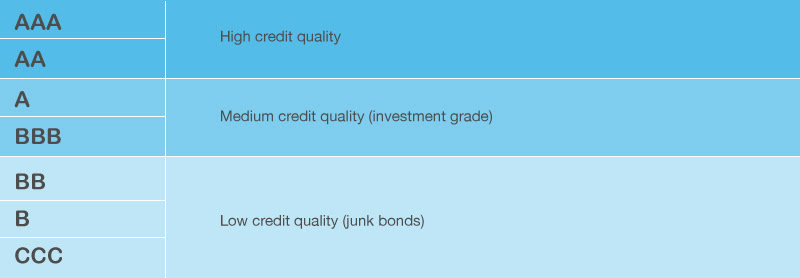

For risk averse investors malaysia government securities are good alternatives since these bonds are issued by the malaysia government and are widely considered to be free from credit risk. The malaysia credit rating is a according to standard poor s agency. Transaction cost calculator allows you to compute the net proceed for your buy or sale of the bond sukuk. If you wish to sell bonds purchased through the bank the bank may repurchase it on best effort basis based on the prevailing market price under normal market circumstances but the buying price may differ from the original.

In malaysia corporate bonds are predominantly issued to sophisticated investors. However in the municipal bond. Buying municipal bonds follows more traditionally with the standards in the bond market overall. Current 5 years credit default swap quotation is 45 30 and implied probability of default is 0 76.

Extensive research analyses on funds and global markets and portfolios. For investors who willing to take on more risk they can consider the wide variety of corporate bonds currently available on fsm bond. The names of distributors in the eligible distributors list here are approved by the securities commission malaysia and will continue to be updated when new distributors come into the market.