How To Calculate Accrued Interest Expense

Accounting for accrued interest expense.

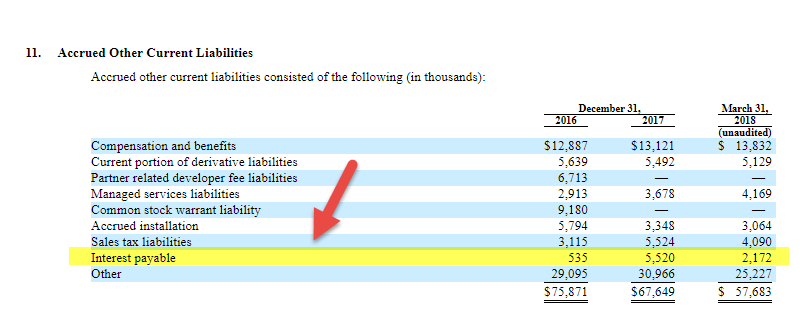

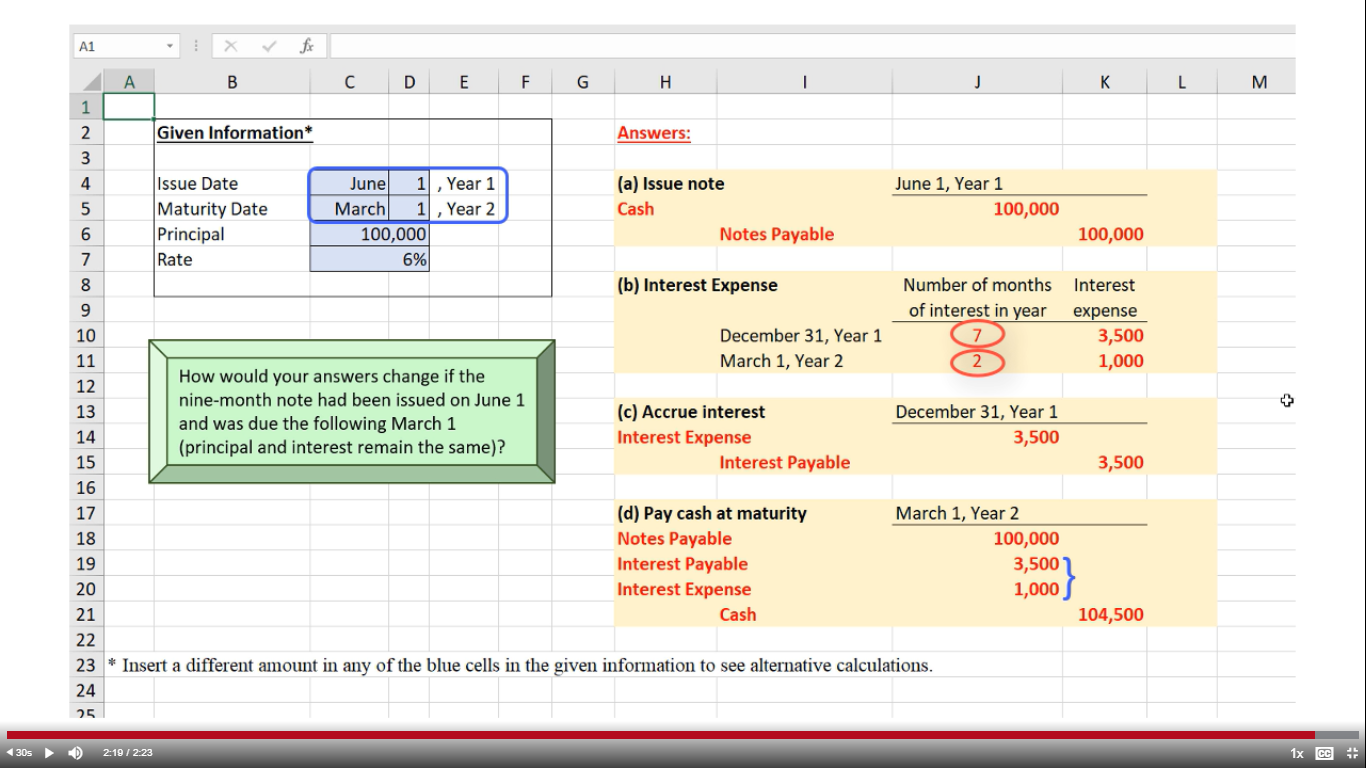

How to calculate accrued interest expense. Determine the time period over which the interest expense is being calculated. The expense is recorded in the accounting period in which it is incurred. Debit the appropriate expense account and credit the appropriate. For the accrual accounting principle to be followed companies need to maintain the accrued interest portion and report the same in the financial statements during reporting 10q and 10k.

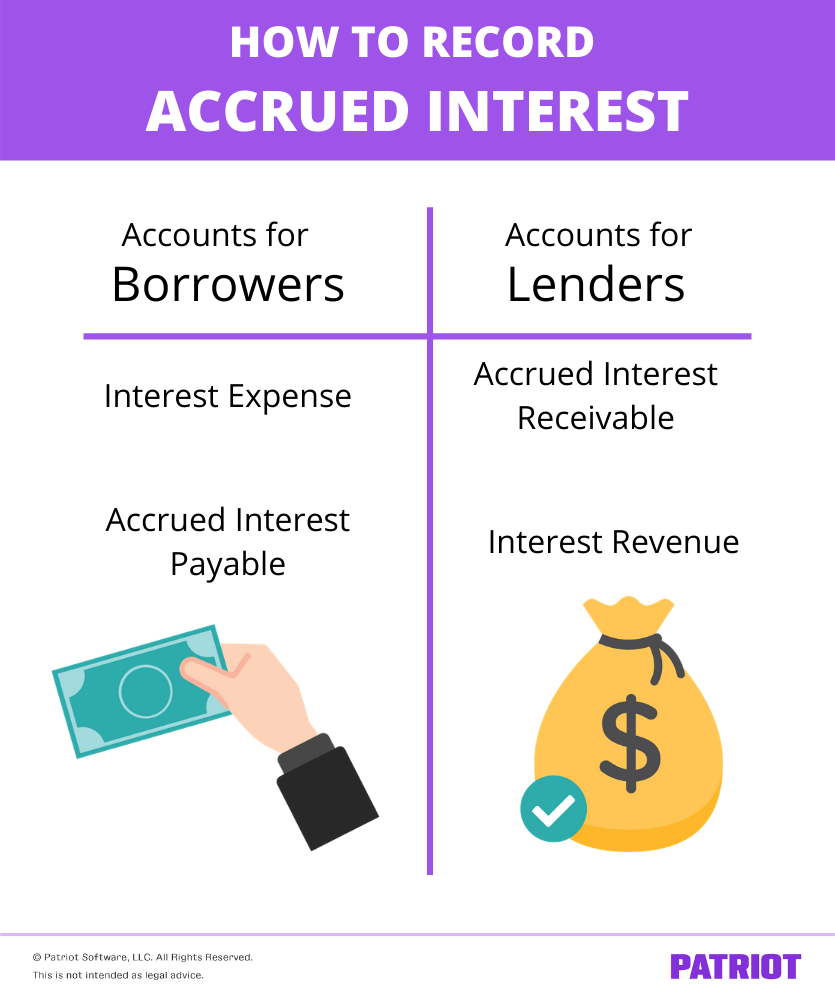

You accrue expenses by recording an adjusting entry to the general ledger. Adjusting entries occur at the end of the accounting period and affect one balance sheet account an accrued liability and one income statement account an expense. The adjusting entry should be made as follows. In this case the company creates an adjusting entry by debiting interest expense and crediting interest payable.

Next figure out your daily interest rate also known as the. The accrued interest is also reported by the companies in the income statement below the operating items under the heading interest expenses. The interest expense on profit and loss statement is increased by the amount of the interest that is yet to paid by the company. For example 7 would become 0 07.

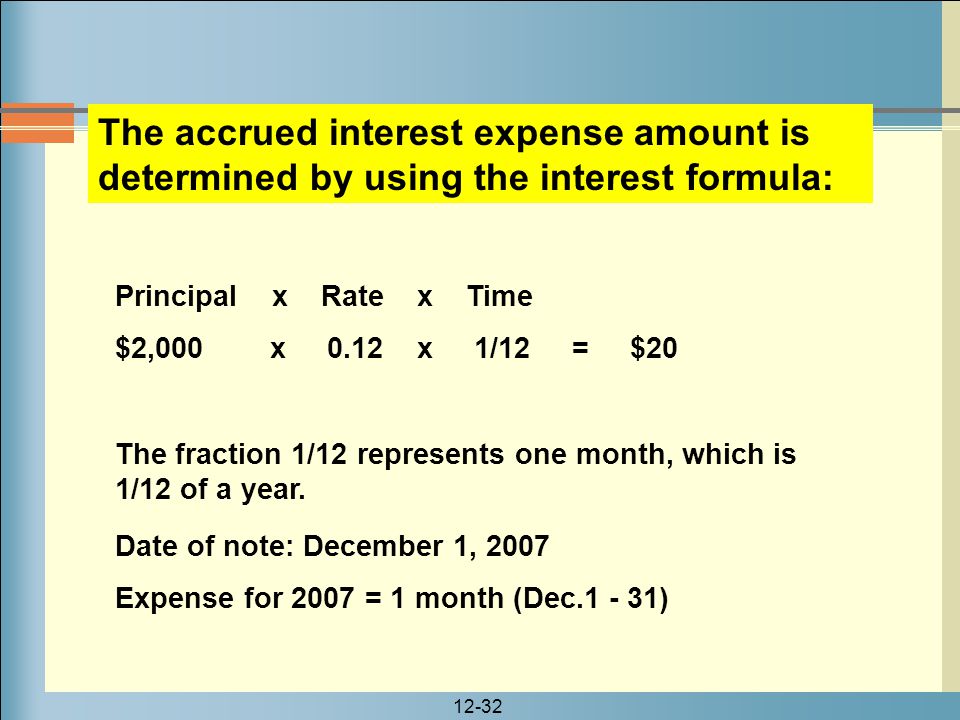

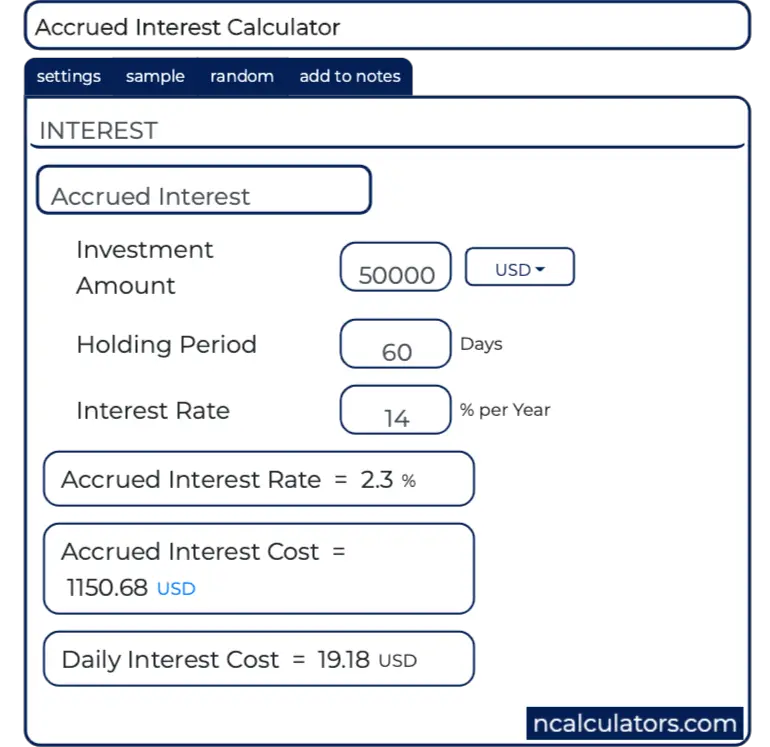

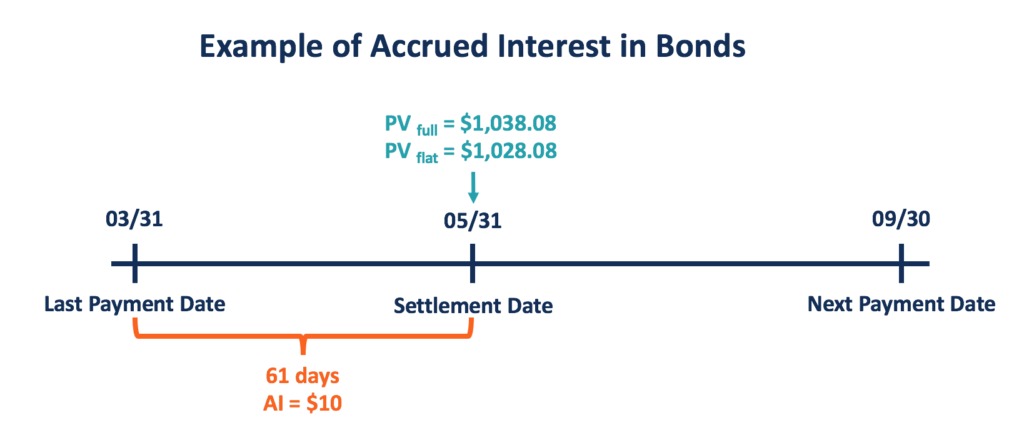

While accounting for accrued into two sets of accounts is adjusted the interest expenses account on the profit and loss statement and the accounts payable on the balance sheet. The size of the entry equals the accrued interest from the date of the loan until. Interest rate percentage time period number of days the interest accrued over loan or credit amount once you know these three pieces of information you can plug them into the accrued interest formula. Calculating accrued interest during a period to calculate accrued interest you need to know three things.

Example of accrued interest. An accrued expense is an accounting term that refers to an expense that is recognized on the books before it has been paid. To calculate the accrued interest. Interest expense when you borrow money from a bank one of the ways the bank earns money on the loan is by charging interest.

Interest expense is the cost of the funds that have been loaned to a borrower to calculate interest expense follow these steps. Determine the amount of principal outstanding on the loan during the measurement period. Consider the following example. 05 x 1 000 x 104 360 14 50.

Make the appropriate adjusting entry.