How To Calculate Epf

Details which you need to provide are as below.

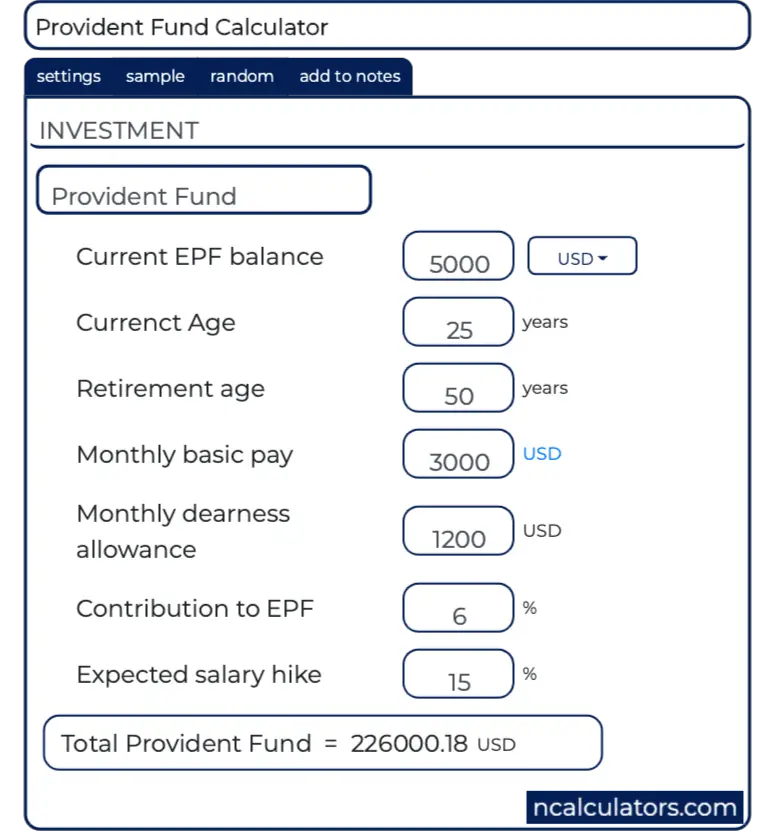

How to calculate epf. Forever for unlimited employees. Excel based free download. While in savings these funds may be used in. How to use epf calculator.

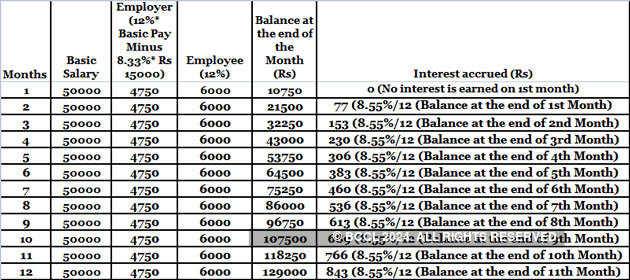

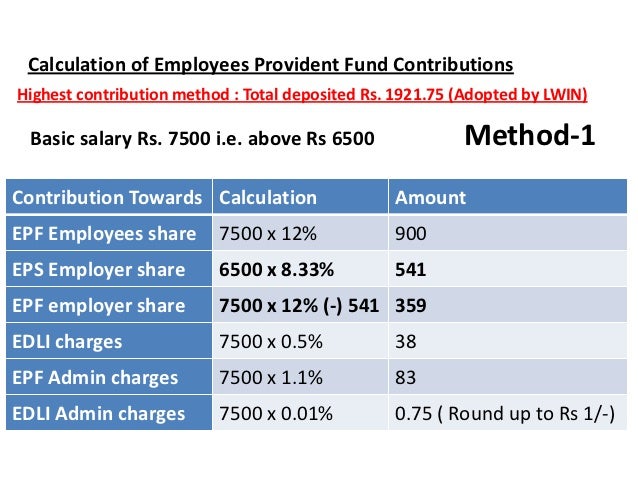

Know all about pf and epf benefits. Your present age and the age when you wish to retire. How to use it to arrive at the retirement corpus you need to enter few details such as. Interest on the employees provident fund is calculated on the contributions made by the employee as well as the employer contributions made by the employee and the employer equals 12 or 10 includes eps and edli of his her basic pay plus dearness allowance da.

A useful online epf pension calculator for you to calculate your future pension salary. The employees provident fund calculator will help you to estimate the epf amount you will accumulate at the time of retirement. Overview the epf employees provident fund is a malaysian government agency that manages a compulsory savings plan and retirement planning for private and non pensionable public sector employees. So if you are a salaried employee who regularly contributes to his her employee provident read more epf calculator 2020.

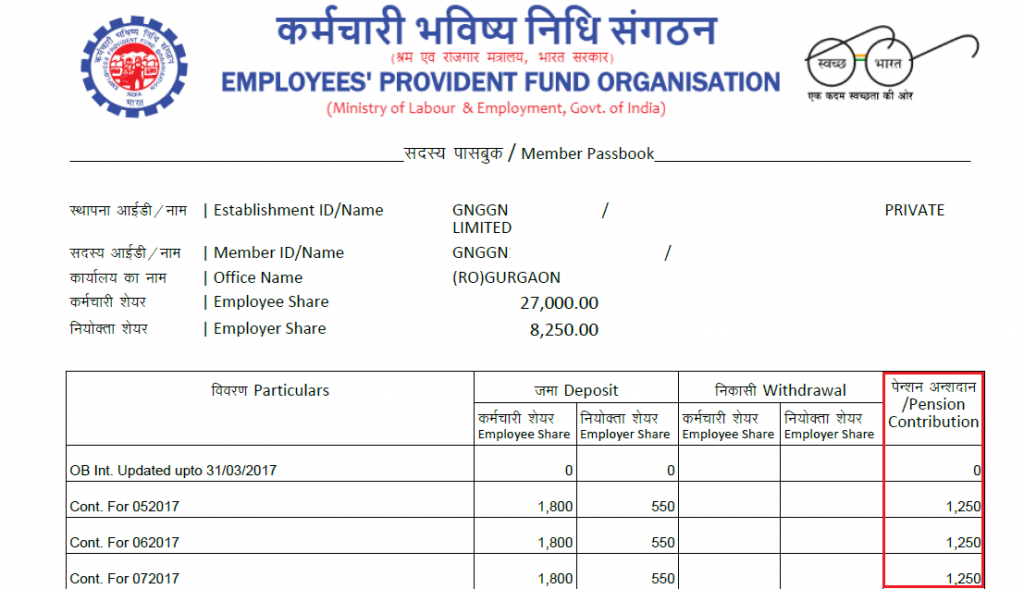

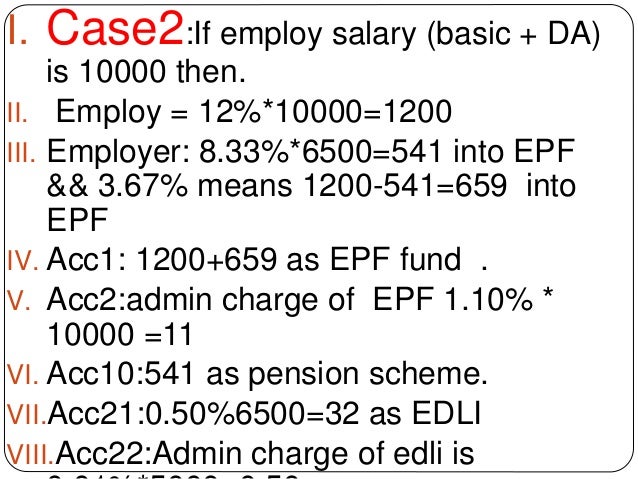

The employee pension scheme calculation is based on the age date of joining of service the estimated or the salary recieved after completion of service 58 years and the pensionable part of your salary. Therefore the employer s contribution towards epf will be rs 15 000 3 67 rs 550 5. It easily calculates the return on your epf contribution within no time. The epf functions through monthly contributions from employees and their employers towards saving accounts.

A 10 rate is applicable in the case of establishments with less than 20 employees sick units or units that meet certain. Employees provident fund epf is a retirement benefits scheme where the employee contributes 12 of his basic salary and dearness allowance every month. If you need more flexible and better payroll calculation such as generating ea form automatically or adding allowance that does not contribute to pcb epf or socso you may want to check out hr my free malaysian payroll and hr software which is absolutely free. 3 67 goes to employee provident fund and 8 33 set aside for employees pension scheme.

The employer also contributes an equivalent amount 8 33 towards eps and 3 67 towards epf in the employee s account the employee can withdraw the accumulated corpus at the time of retirement and also during the service period under. Epf calculator is an online tool and hence can be used anywhere anytime. The employees provident fund epf calculator will help you to calculate the amount of money you will accumulate on retirement. Btw payroll my pcb calculator 2020 is powered by hr my s payroll calculator.