How To Calculate Income Tax Expense On Income Statement

A ccounting for income taxes ias 14 determining income tax paid.

How to calculate income tax expense on income statement. As mentioned above income tax involves an outflow of cash and hence it is seen as a liability for the company. Important points about income tax expense income statement. The company s taxable income that is income net of tax deductions and non taxable items is 1 000 000. The following are the important points about this tax expense.

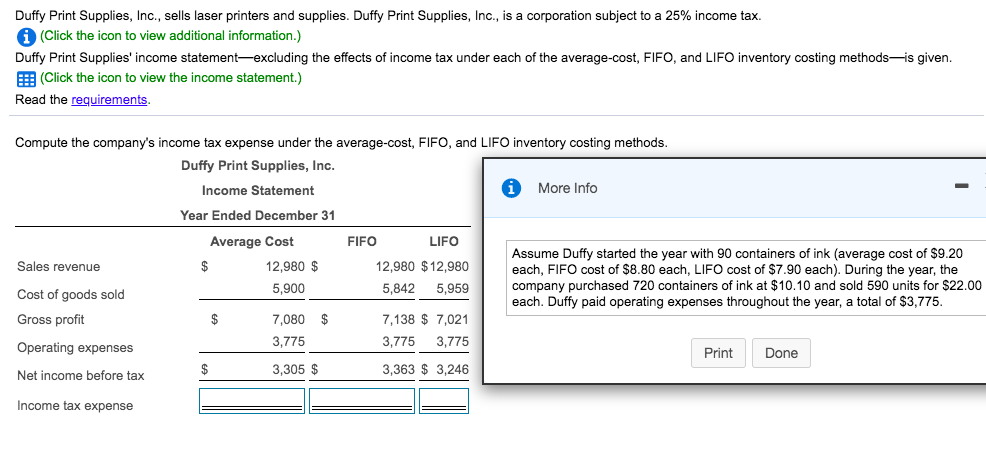

1 minimizing taxable income. Numerous and diverse techniques. The most straightforward way to calculate effective tax rate is to divide the income tax expenses by the earnings or income earned before taxes. A tax expense is a liability owing to federal state provincial and municipal governments.

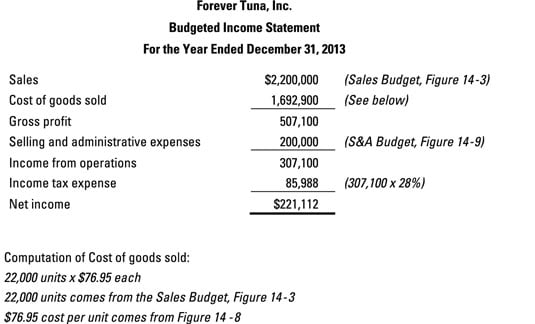

Next figure out all the tax deductions and credits applicable to the company. Interest expense rate of interest debt. Profit or loss is determined once all the expenses of the company are subtracted from revenue or sales for that period. Another carefully watched indicator of profitability earnings garnered before the income tax expense is an important bullet in the income statement.

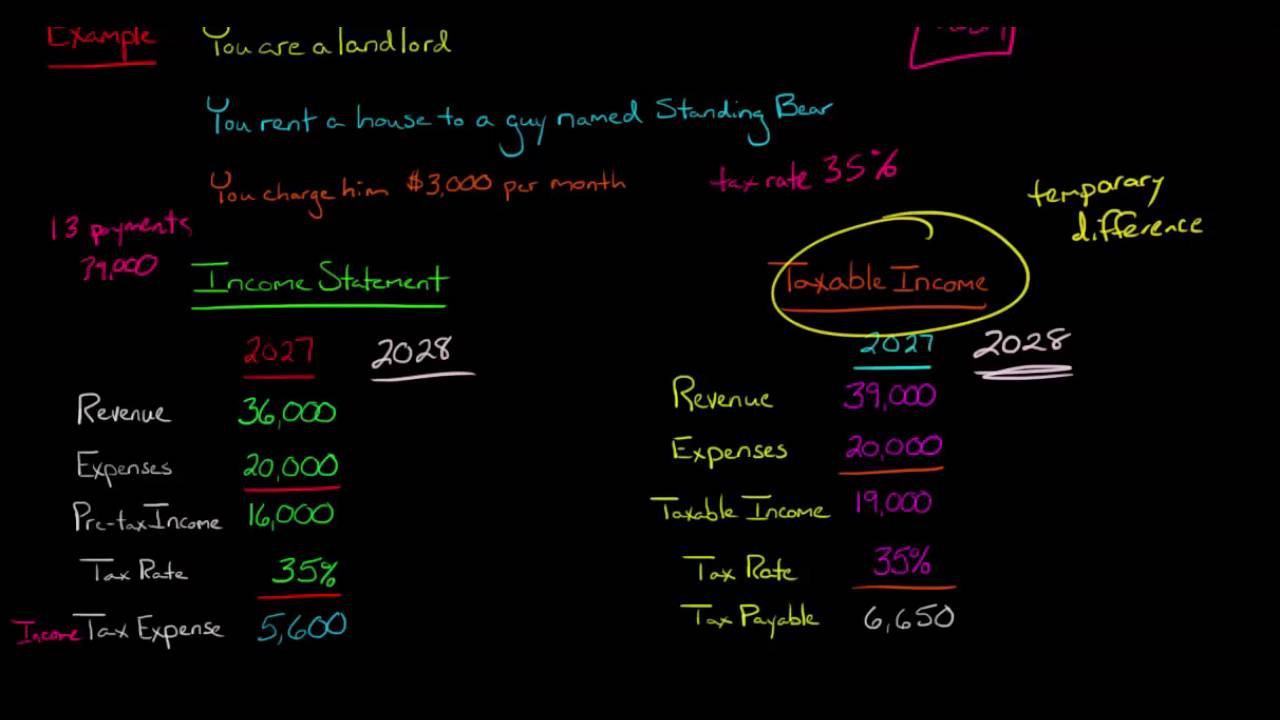

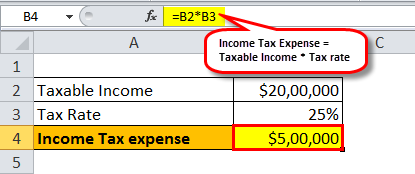

Of course in the real world calculating tax expense is far more complicated. According to the formula company xyz s tax expense would be. Tax expense 1 000 000 x 0 35 350 000. The income statement is also referred to as the statement of earnings or profit and loss p l statement.

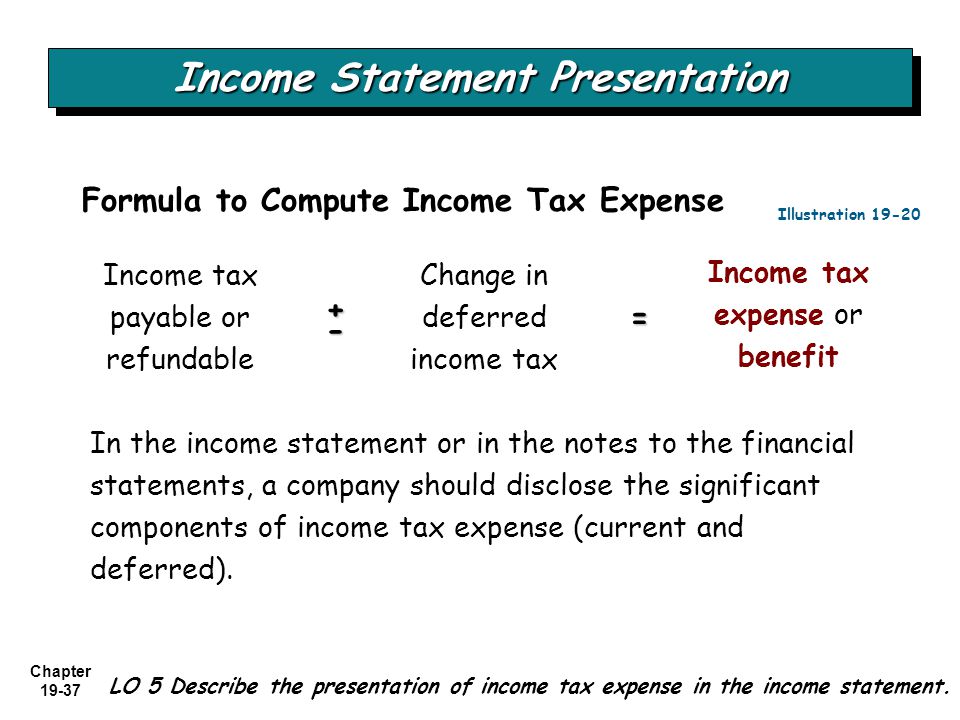

This income statement formula calculation is done by a single step or multiple steps process. Instructor let s talk about tax expense tax expense deals with the tax rate and even though the marginal tax rate may be variable based on your revenue let s pretend that the average tax rate is about 35 including state and federal taxes now the fact of the matter is that this number will vary tremendously and as you very well may know there are several large. In the case of a single step the income statement formula is such that the net income is derived by deducting the expenses from the revenues. The determination of income tax paid can be complex because in addition to current tax payable the application of tax effect accounting can generate deferred tax assets and deferred tax liabilities again some of the movements in the current and deferred tax accounts may not be reflected in the income tax expense.

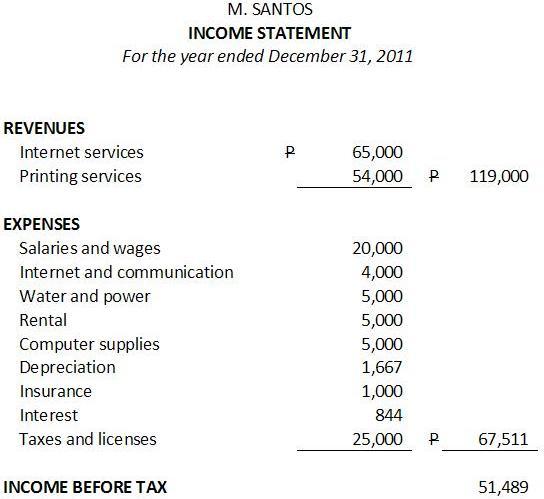

The income statement is one of the major financial statement for a business which shows its expenses revenue profit and loss over a period of time. Tax expenses are calculated by multiplying the appropriate tax rate of an individual or. Finally the calculation of taxable income. Certain types of income are subject to certain levels.

For example if a company earned 100 000 and.