How To Calculate Interest Rate In Excel

Or let s say 100 is the principal of a loan and the compound interest rate is 10.

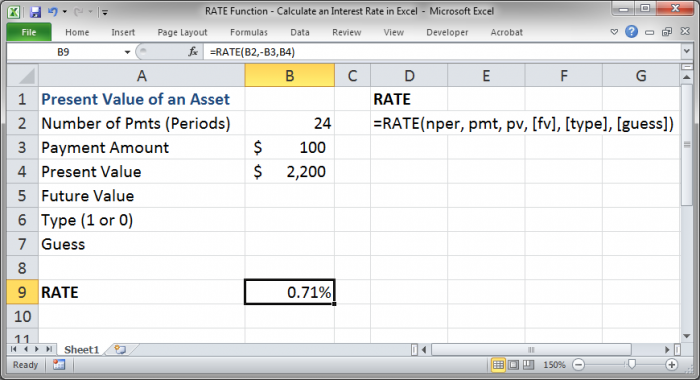

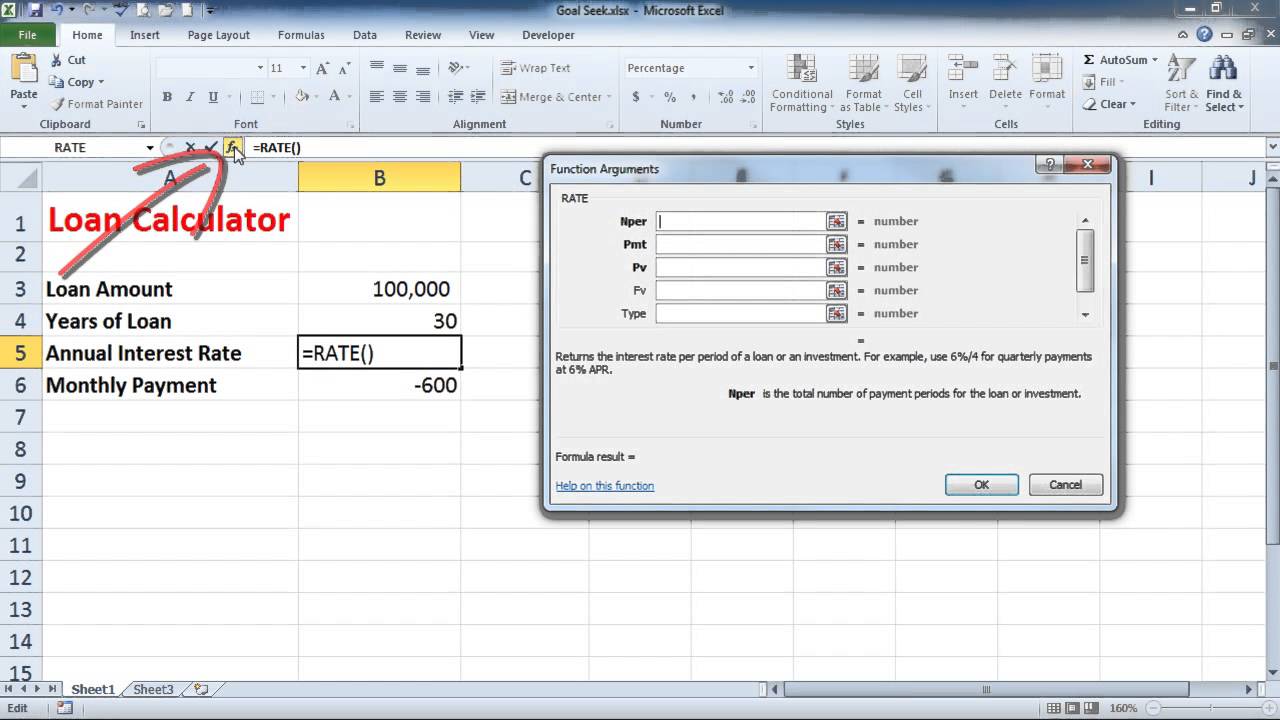

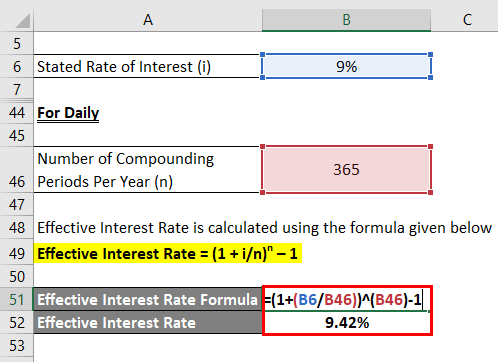

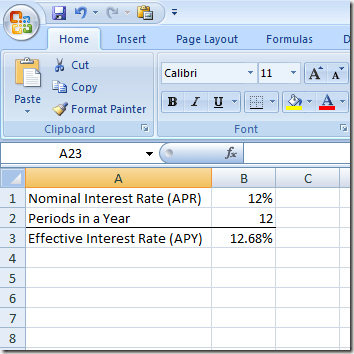

How to calculate interest rate in excel. This doesn t give you the compounded interest which generally gets lower as the amount you pay decreases. To calculate simple interest in excel i e. The rate function calculates by iteration. Calculate the effective interest rate using the formula above.

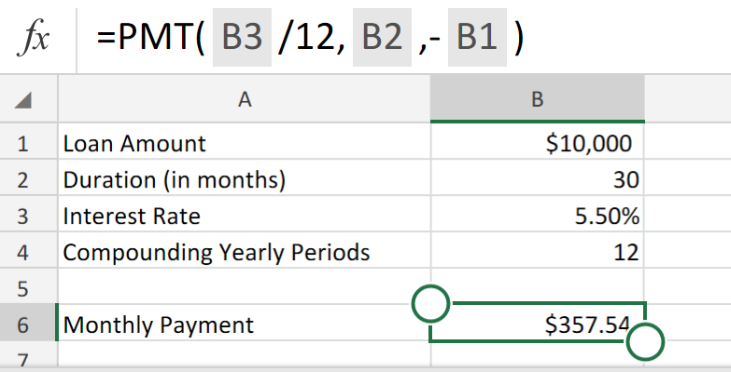

R 1 05 365 365 1 or r 5 13 percent. Type ipmt b2 1 b3 b1 into cell b4 and press enter doing so will calculate the amount that you ll have to pay in interest for each period. The rate per payment period is calculated using the formula rate 1 r n n p 1 and the total number of periods is nper p t where. One use of the rate function is to calculate the periodic interest rate when the amount number of payment periods and payment amount are known.

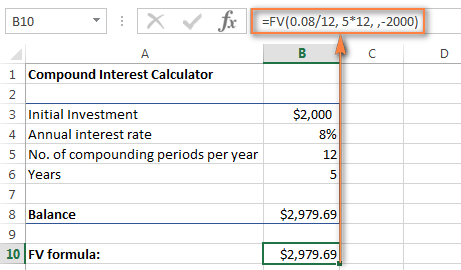

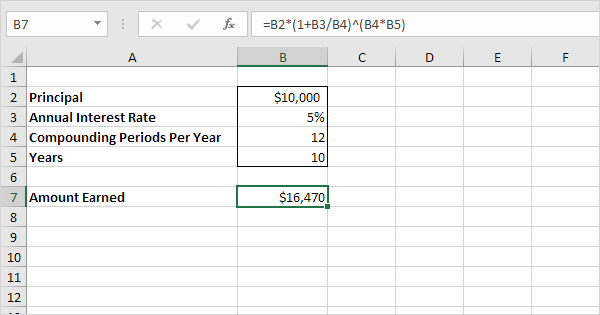

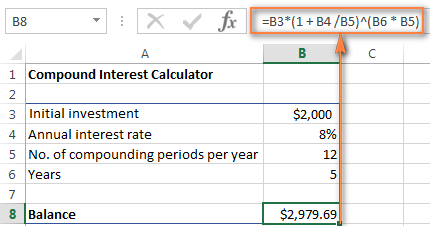

For periodic constant payments and constant interest rate you can apply the ipmt function to figure out the interest payment for every period and then apply the sum function to sum up these interest payments or apply the cumipmt function to get the total interest paid on a loan directly in excel. This example assumes that 1000 is invested for 10 years at an annual interest rate of 5. Interest that is not compounded you can use a formula that multiples principal rate and term. Using the formula yields.

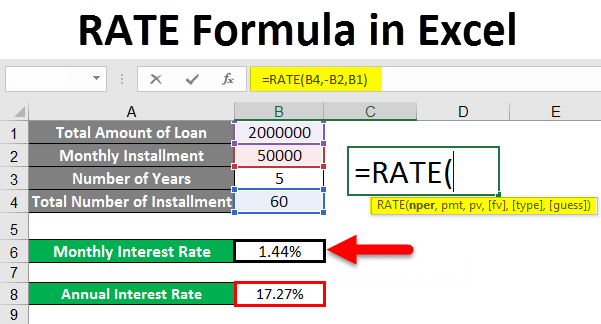

However because the values are. Sometimes you may want to calculate the total interest paid on a loan. R 1 05 12 12 1 or r 5 12 percent. The excel rate function is a financial function that returns the interest rate per period of an annuity.

Microsoft excel is a good program to use when making financial decisions. After one year you have 100 in principal and 10 in interest for a total base of 110. Simple interest on 500 invested at the rate of 6 per annum for 10 years. Enter the interest payment formula.

You can use rate to calculate the periodic interest rate then multiply as required to derive the annual interest rate. The same loan compounded daily would yield. N the number of compound. Interest amount x rate x years 3000 x 10 x 2 600.

Among the many functions it can perform excel can help you calculate the interest rate of a loan or an investment. For this example we want to calculate the interest rate for 5000 loan and with 60 payments of 93 22 each. How to calculate an interest rate using excel. R the nominal annual interest rate in decimal form.

The nper function is configured as follows. For example consider a loan with a stated interest rate of 5 percent that is compounded monthly.