How To Remove Employee From Epf Contribution Malaysia

Or the employee was eligible for pcb but no deductions were made.

How to remove employee from epf contribution malaysia. Failing to submit within the stipulated period will result in a late penalty charged by kwsp. For most of us we know or at least heard of epf which also known as kwsp in local malay language. Membership of the epf is mandatory for malaysian citizens employed in the. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from.

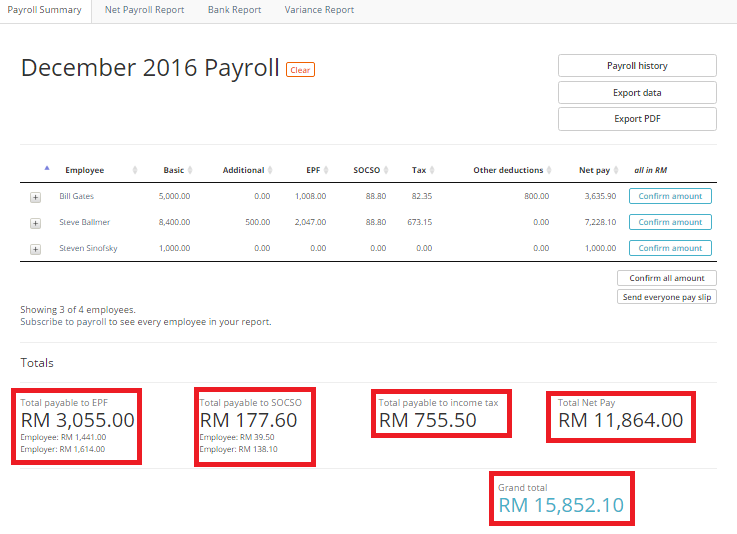

The minimum wages of rm1 100 are set for both peninsular malaysia and sabah and sarawak. The new rate will be effective starting 1 april 2020 until the end of the year and affects members below age 60. Every company is required to contribute epf for its employees made up from the employee s and employer s share and to remit the contribution sum to kwsp before the 15th day of the following month. The malaysian government has reduced the minimum employee contribution rate for the employees provident fund epf to 7 starting from april 1 in a bid to cushion the impact of the covid 19.

Because employer and employee in malaysia must contribute a portion of their monthly salary to epf savings as a retirement fund. The new statutory contribution rate for employees will impact wages paid for april until december 2020 which are reflected in epf contribution submissions from may 2020 till january 2021. The employees provident fund epf or commonly known as kumpulan wang simpanan pekerja kwsp is a social security institution formed according to the laws of malaysia employees provident fund act 1991 act 452 which manages the compulsory savings plan and retirement planning for private sector workers in malaysia. If you fail to do so you are liable to prosecution and if convicted liable to a fine of not less than rm200 and not more than rm2 000 or to imprisonment for a.

The employee is about to leave malaysia permanently in this case form cp21 would be submitted instead of form cp22a. Malaysia s employees provident fund epf also known as kwsp kumpulan wang simpanan pekerja has confirmed that the minimum contribution of employees and employers will be aligned with the minimum wages order amendment 2018 effective 1 january 2019. Employees have the option to opt out from the scheme and maintain the rate at 11 by completing borang kwsp 17a khas 2020. Have you heard of epf self contribution.

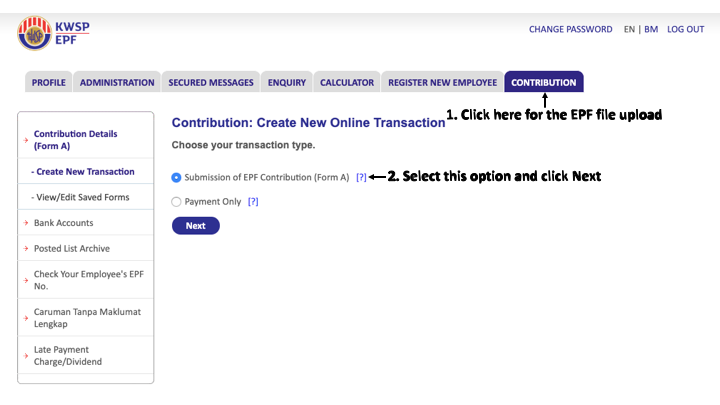

Wages statement salary slip shall include the following. In this video i will show you that how to make payment online on kwsp epf website link is below web. The employer is responsible to contribute the employee s share by deducting the employee s salaries and the employer s share. Whereas for epf self contribution i believe many of us are still unaware of it.

The contribution amount of employer and employee shares shall be based on the contribution rate third schedule of the epf act 1991.