How To Use Credit Card Wisely

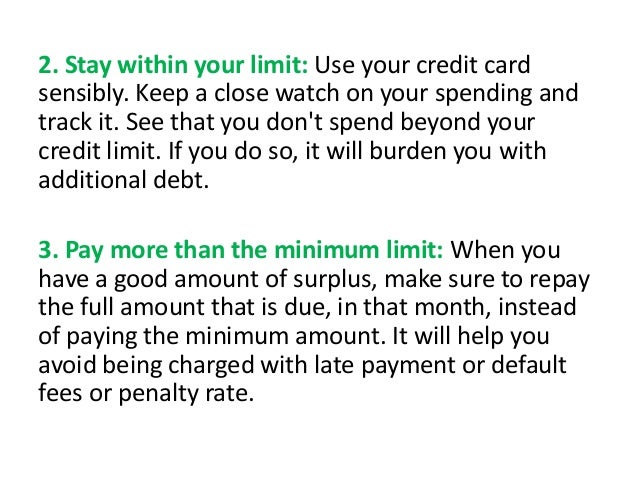

Only charge what you can afford.

How to use credit card wisely. Learning how to use a credit card wisely helps us to save money in the long run and avoid the trap of ongoing debt. Credit cards can sometimes get a bad rap in their relation to credit scores. 6 habits to help you use your credit wisely keep the health of your credit score top of mind with these six tips. However the key is to use the card wisely and not let spending get out of hand or payment fall by the wayside.

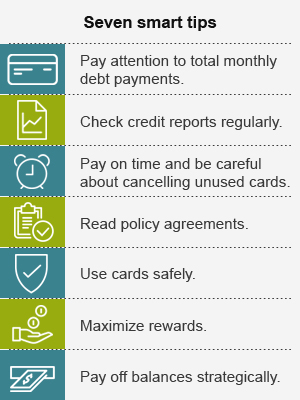

Using credit cards in the right way can help you build wealth and get better loan terms here are 7 tips to help you use credit cards safely and effectively and to help you make the most of their. If it s helpful track your spending to make sure that you re staying within your monthly budget. Credit in the form of credit cards is something most of us want need and use almost every week of our adult lives. Use your credit card to make smart purchases and abstain from overspending to avoid the credit card debt.

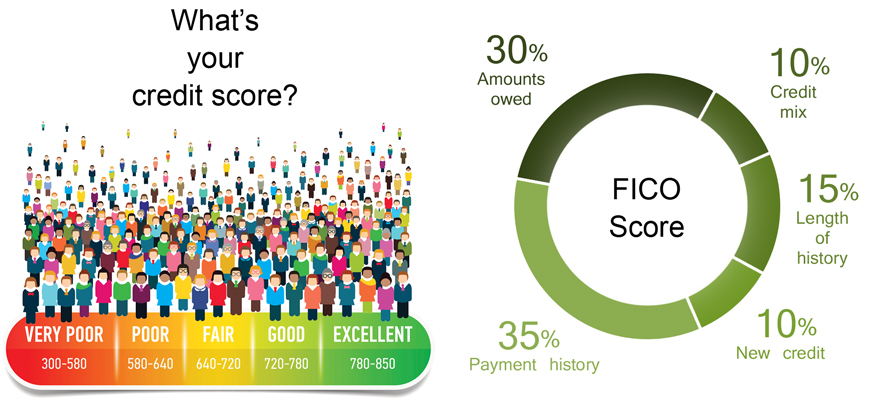

Using credit cards wisely improves your credit score so that you can get the best rates on auto loans mortgages and other financial products including of course other credit cards. Problems with credit cards such as late or missed payments stay in your credit report for seven years. Used wisely credit is an important tool in your financial toolbox explains stefan ross vice president of credit card products at fidelity. From paying more than the minimum requirement each month to rewarding your spending here are 10 ways you can use your credit card smarter.

To avoid that only charge. October 26 2018. Read these 6 tips for how to use your credit cards wisely earning rewards and staying out of debt. Pay the credit card installments timely.

Pay your bills on time. Use your card wisely and follow a few rules and you can build a good credit history. Truthfully a credit card is a great way to build credit. Here s how to use a credit card wisely.

Don t cancel credit card accounts. Tips for handling credit if a credit card is in your name you are responsible for paying the bill. Best credit cards against fixed deposit in india highlights discussion. Credit cards and loans e g car loans student loans and lines of credit.

Ensure that you pay your credit card payments on time in all cases. Don t let credit card companies get the best of you.